Is that the chill of a winter storm we feel coming? Or is it just the frigid heart of tax season bearing down on us all?

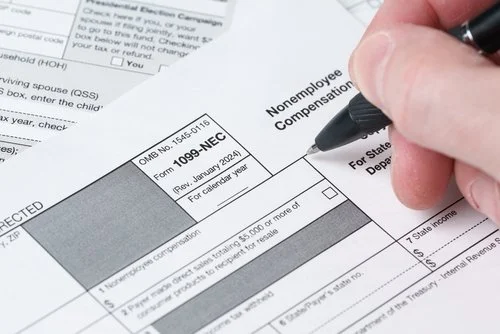

One quick update to keep on your radar: 1099 reporting thresholds.

Beginning with payments made after December 31, 2025, the IRS has increased the reporting threshold for Form 1099-MISC and Form 1099-NEC:

Old threshold: $600

New threshold: $2,000

This change will be indexed for inflation after 2026, meaning the threshold will almost certainly continue to adjust in future years.

What does this mean for schools? While this won’t impact reporting for the 2025 tax year, it’s a great time to start planning ahead—especially if your school regularly works with independent contractors, consultants, or other non-employees. As a reminder, we recommend routinely seeking updated W-9s from those individuals. Lastly, the IRS published instructions regarding these form updates on December 23, 2025. They are available here.

If you run into any questions this tax season, our email is ready at ksb@ksbschoollaw.com